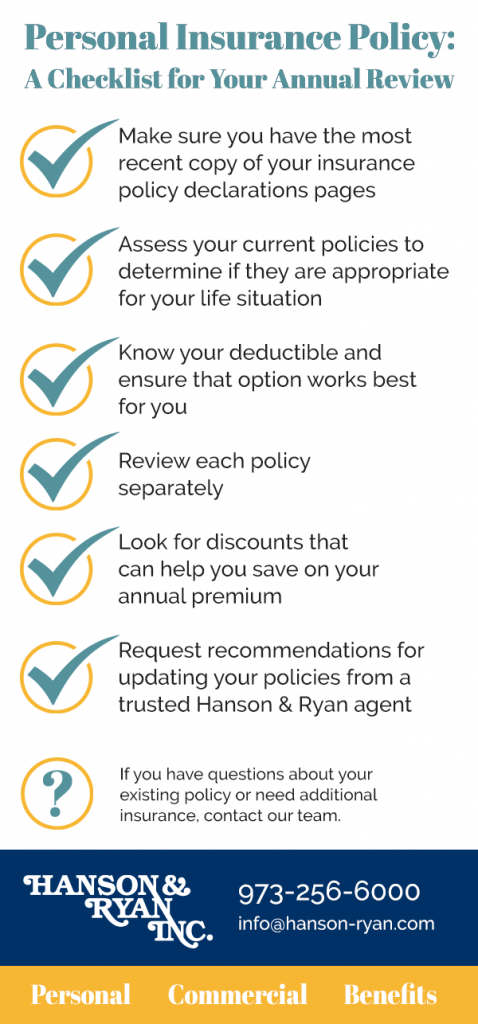

Conducting an Annual Personal Insurance Review

Each year it is important to have a review of your personal insurance policies to make sure they are up to date and are covering some of your most precious assets properly. Follow our tips below for making sure all your personal policies fit your needs.

Annual Insurance Review Tips

As we all know anything can happen within a year (especially 2020). As our lives are constantly changing so are our insurance needs. There will never be a better time than now to review your insurance policies to make sure you and your possessions especially your auto and home are covered accordingly.

Make sure you have all your policy information

For starters, make sure you have the most recent copy of your insurance policy declarations pages, agent contact information and claim contact information for your carriers. Having all this information filed together can make a world of a difference when questions or (hopefully not) a claim were to arise.

Keeping your insurance information organized is our #1 tip. You don’t want to be scrambling for your insurance information when there is a leak in your roof, or you just had an auto accident. Always have your insurance information and contact information easily accessible in case a claim arises.

Look over your policies

Now that your have all your policies organized, we suggest reading through them and learning what your limits, coverages and exclusions on each policy are. Of course, there will be questions about certain coverages, this is what your agent is here for. Jot down any questions you have and bring them up to your agent for explanation (we all know that insurance policies can be very confusing)

What is your deductible?

Your deductible on your policy is the amount of money you will be required to put out of pocket if something should happen and you need to file a claim. Increasing your deductible is one way of providing a savings on your annual premium. Deductibles can be increased and decreased at any time. We suggest speaking with an agent so they can help determine the deductible option that works best for you.

Review each policy separately

Here are some good tips for reviewing each policy individually:

Auto Insurance

Is one of your children turning 17 and getting their license? Has there been a marriage or divorce? Have any family members moved in or out of the home? Have your retired? Is your child away at school? Has the usage of your vehicle changed? All of these are situations you need to consider when reviewing your auto policy. To make sure you have the proper coverage these are all situations that you should speak with your agent regarding as you want to make sure you have the proper coverage.

Homeowners/Dwelling Insurance

You probably know that you can be under-insured, but did you know that you could be over-insured? Always be aware of your dwelling limit, this is the amount your home is insured for and used if the home needs to be rebuilt from the ground up from a covered loss. Check if your policy includes some amount of additional replacement cost, this endorsement provides an additional percentage of the dwelling limit to rebuild the home if the cost of rebuilding goes over the dwelling limit. In regard to the dwelling limit if you feel you are under or over insured contact your agent and with some basic information on the home, they can run a “Replacement Cost Estimator” which determines the value your home should be insured for.

Did you put in a new pool? Have you added an addition to your home? Did you remodel and update your kitchen or bathrooms? If you answered yes to any of these questions you will need to update your insurance policy. Since these are “upgrades” to the home you will need to make sure they are insured for on your policy.

We also suggest taking inventory of your personal property, having an inventory helps in case of a claim. Also, if you have a higher value item such as jewelry or memorabilia, we suggest getting appraisals done and specifically scheduling the items on the insurance policy, so they are insured for their specific value. If big ticket items such as an engagement ring or that Babe Ruth autograph is not scheduled on the insurance policy coverage falls under your standard personal contents coverage and if the item is lost/stolen or lost in a fire you may not get the full value for the item when putting in a claim.

Renters Insurance

Why do you need insurance if you rent? If you are a renter, you will be insured for your contents which is your personal property, this is everything from dish/bathroom towels, kitchenware, furniture, clothing, electronics etc. Did you get a new TV for Christmas? How about that new bedroom set you finally purchased? Take inventory each year to make sure that you have enough coverage for your contents and in case of a of a catastrophic loss. We have seen a few cases of insureds losing all their personal belongings in a fire, and guess what… they did not have a renter’s insurance policy. Since there was no renter’s policy in place there was no coverage for their personal belongings. Coverage for your personal belongings does not fall under the owner of the property’s insurance policy.

Umbrella Insurance

Umbrella insurance is not a required coverage, but we highly recommend it to all of our insureds. This policy provides and additional amount of Liability Insurance above what your Home and Auto policies provide. If you do not currently have an umbrella insurance policy now is a great time to reach out to your agent to get a quote. Umbrella policies provide additional liability coverage starting at $1,000,000 for minimal premium.

Do you have a child that just started driving? Do you own homes/condos that you rent out? Do you have a pool? These are all factors that should go into purchasing an umbrella insurance policy.

Look for discounts

Who does not want to save money? Did you know that bundling your auto, home and umbrella insurance with the same company can provide major discounts? Are you part of a motor club? Are you a doctor? Are you a teacher? Call your agent today to discuss all possible discounts that can be added to your current policies and bundling your insurance policies.

Wrap up

In all your insurance policies are only as good as the coverage they provide. Keeping your policies up to date is essential and having an annual review will help make sure you and your assets are insured properly. Contact us today to schedule your review with one of our insurance experts.